- Attend to receive timely regulatory updates, valuable compliance information, and to learn the latest on different investment products, programs and more

- Continuing education credits will be available

- Conference attendance is balanced, representing all sponsors, service providers and funding sources

- Ample networking time will be available

Event Details

Event Schedule

*last updated 3/10/2020

Education Tracks

- REIT Track (12) REIT Hot Topic

- Energy Track (16) Third Party Oil & Gas Due Diligence Opinions

- DPP Track (4) Fundamentals of DPP

- 1031 Track (1) Deconstructing Master Leases

(15) Preferred Stock Offering

(20) What Was Old is New Again: The Real Estate Private Placement Boom

(28) Essential Pieces of the Puzzle for Small Offering Success

(19) Energy 2018: Tax Changes

(10) Best Practices of DPP

(11) Underwriting 1031 Real Estate Opportunities

(13) Delaware Statutory Trust Financing Structures

(21) Deferring Taxes: 1031 Exchanges vs. Installment Sales

- RIA/Broker-Dealer Track (8) Practice Management for IARs

- Technology & Security Track (6) The Next Frontier: Using Technology to Improve the Asset Manager or Broker-Dealer/Shareholder Experience

- New & Innovative Track (9) Late-Breaking New Product Investigation

- Miscellaneous Alternatives (2) The Next Act for BDCs: A Discussion of Current Issues Facing BDCs & How Sponsors Can Capitalize in a Changed Environment

(14a) Practice Management for Registered Reps

(26) Broker-Dealer Advisory Council

(18) Cyber Attack: Proactively Planning for an Organizational Breach

(24) Safe Block Chain and Cryptocurrency

(3) Making the World a Better Place! Conservation and Investment Can Co-Exist

(5) The Ease of Buying Alternative Investments in "Street Name"

(7) Tax and Taxes

(14) Interval Funds: What Are They Good For?

(17) Reg A+

(22) Debt Offerings

(23) Examing the Current Private Equity Landscape and Predicting the Future

(25) Battle of the Due Diligence Stars

(27) Marketing for New Sponsors

Special Guests

.tmb-thmbmw260.jpg?Culture=en&sfvrsn=6aab17ca_1)

Cheri Tree

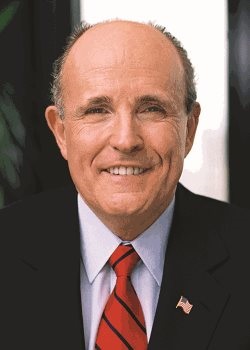

Rudy Giuliani

After joining the office of the United States Attorney for the Southern District of New York, Giuliani rose quickly through the ranks, becoming the chief of the Narcotics Unit at age 29.

In 1983, President Reagan appointed Giuliani as the United States Attorney for the Southern District of New York. Giuliani spearheaded successful efforts against organized crime, white-collar criminals, drug dealers and corrupt elected officials. Few U.S. Attorneys in history can match his record of 4,152 convictions with only 25 reversals.

In 1993, Giuliani was elected Mayor of the City of New York. Campaigning on the slogan “One City, One Standard,” he focused on reducing crime, reforming welfare, and improving the quality of life. In 1997, he was re-elected with 57% of the vote in a city in which Democrats outnumbered Republicans five to one.

Under his leadership, overall crime was cut by 56%, murder was cut by 66%, and New York City—once considered the crime capital of the country—became the safest large city in America according to the FBI. New York City's law enforcement strategy has become a model for other cities around the world. This is particularly true of the CompStat statistical accountability program, which won the 1996 Innovations in Government Award from the Kennedy School of Government at Harvard University.

When Giuliani took office, one of every seven New Yorkers was on welfare. Giuliani implemented the largest and most successful welfare-to-work initiative in the country, turning welfare offices into Job Centers and reduced welfare rolls by 640,000—nearly 60%.

On September 11, 2001, America suffered the worst attack in its history when terrorists crashed planes into the Twin Towers of the World Trade Center. Thousands of New Yorkers were killed, including hundreds of members of the city's uniformed services, who rushed to the scene to lead the heroic rescue of tens of thousands of people. Having narrowly missed being crushed when the Towers fell, Giuliani immediately began leading the recovery of the city as it faced its darkest hour. Giuliani was widely lauded for his steady hand during challenging times. He was named “Person of the Year” by TIME magazine, knighted by the Queen of England, dubbed “Rudy the Rock” by French President Jacques Chirac, and former first lady Nancy Reagan presented him with the Ronald Reagan Presidential Freedom Award.

Limited by New York City law to two terms as mayor, Giuliani founded Giuliani Partners in January, 2002, quickly establishing the professional services firm as a leader in emergency preparedness, public safety, leadership during crises, and financial management. Drawing on his experience in turning a city described as ungovernable into a city that is now a worldwide example of good government and effective management, Giuliani was recognized in the Spring 2002 as “Consultant of the Year” by Consulting magazine. Currently, Giuliani serves as a Senior Advisor to Greenberg Traurig’s Executive Chairman and as the Chair of the Cybersecurity, Privacy and Crisis Management Practice. Greenberg Traurig is an international law firm with nearly 1900 attorneys worldwide.

In May of 2003, Giuliani married Judith S. Nathan, who was at the time a Managing Director of Changing Our World, Inc., a national fundraising and philanthropic services company headquartered in New York. Prior to joining Changing Our World, Mrs. Giuliani, a registered nurse with an extensive medical and scientific background, worked with U. S. Surgical Corporation and Bristol-Myers Squibb. In the aftermath of September 11, 2001, Mrs. Giuliani helped coordinate the efforts of the Family Assistance Center at Pier 94. Judith was a Founding Member of the Board of Trustees of the Twin Towers Fund, which raised and distributed $216,000,000 to over 600 recipients.

In 2008, Giuliani ran for the Republican nomination for President of the United States. During his campaign, he galvanized the national debate on such critical issues as national security, education, energy independence, healthcare, and the economy. The policy commitments Mayor Giuliani made to the American people remain vitally important to America’s future.

Marilyn Mohrman-Gillis, Esq.

A highly regarded leader within the financial planning community, Mohrman-Gillis was appointed the Center’s first Executive Director in 2016 to lead a profession-wide effort to build a more inclusive and sustainable financial planner workforce. She guides the development and implementation of research and programmatic initiatives focusing on workforce development, diversity, and advancing the profession’s body of knowledge.

Mohrman-Gillis joined CFP Board as Managing Director of Public Policy & Communications in 2008. In that role, she developed and oversaw CFP Board’s advocacy initiatives to ensure the visibility and credibility of the CFP® certification with legislators, regulators and other policy makers. Under her tenure, CFP Board became a nationally recognized leader in areas related to investor protection, the delivery of financial advice under a fiduciary standard, and advancing standards to promote competent and ethical financial planning services to the public.

Adept at developing strategic partnerships to advance common goals, Mohrman-Gillis helped create the Financial Planning Coalition, which – along with members CFP Board, the Financial Planning Association and the National Association of Personal Financial Advisors – helped influence policy outcomes to benefit the public. On behalf of the Coalition, Mohrman-Gillis was recognized as a key spokesperson in support of the Department of Labor’s 2016 fiduciary rule, testifying at several public hearings including on Capitol Hill.

Prior to joining CFP Board, Mohrman-Gillis established an impressive track record of successful advocacy on behalf of the American public during a 30-year career in Washington. She began her career as a litigator in the Washington, DC, office of the law firm Steptoe & Johnson.

Mohrman-Gillis has a BA in Psychology from St. Mary’s College, Notre Dame, a MSW from Catholic University and a JD from the Columbus School of Law, Catholic University.

Attending Companies

- Associate Firms

Advisory Group Equity Services Ltd.

Aegis Capital Corp

Alan B Lancz & Associates

Alpha Investing

Alvery Bartlett Group

American Portfolios Financial Services, Inc.

Anchor Captial, Inc

Arete Wealth Management

Arque Capital Ltd.

ASG CAPCO CORP

Atomi Financial Group

Ausdal Financial Partners

Beacon Hill Investment Advisory

Berthel Fisher & Company Financial Services Inc

Bose McKinney & Evans LLP

Breen Financial Management Inc

Bridge Valley Financial Services

Cabin Securities

Cabot Lodge Securities, LLC

Calton & Associates Inc

Cambridge Investment Research Inc

Capital Financial Services, Inc.

CapStack Partners

Centaurus Financial, Inc.

Center Street Securities, Inc.

Centra

Chen Planning Consultants, Inc.

Claraphi Advisory Network, LLC

Clear Harbor Wealth Management

Coastal Equities, Inc.

Colorado Financial Service Corporation

Commonwealth Financial Network

Concorde Investment Services LLC

Cornerstone Exchange Services

Corporate Investments Group, Inc.

Crescent Securities Group Inc

Da Vinci Global Consulting, LLC

Dempsey Lord Smith, LLC

DFPG Investments, Inc.

Discipline Advisors

Diversified Wealth Builders

Eagle Wealth Management Group LLC

Effective 1031 Planning

Emerson Equity LLC

Engineered Financial Solutions LLC

Equifinancial Llc

Family Office Partners, Inc.

FinanceCAPE

First Guardian Group

Folio Investments, Inc.

Fortitude Investment Group LLC,

FourStar Wealth Advisors, LLC

G2J2 INVESTMENT MANAGEMENT

Global Asset Advisors

Great Point Capital

Growthpoint advisors

Hickory Capital, LLC

Highlander Wealth Services, LLC

Huntwicke Securities

IAMC

IBN Financial Services, Inc.

IFSG

IHT Wealth Management

Independent Financial Group, Llc

Independent Financial Services Professional

Ingram Advisory Services

Innovative Advisory Group, LLC

Interactive Wealth Advisors

International Assets Advisory, LLC

IRA Wealth Management

ISC Group

J.W. Cole Financial Inc

Jesse J. Griffin Jr Certified Financial Planner

JRW Investments

Kalos Financial, Inc

Kingsley Family Office

Legacy Wealth Management, LLC

Lincoln Financial Network

Lionchase Holdings

Lowell & Company, Inc.

MAB Investments

Maroon Capital

Massey Financial Group

McDermott Investment Advisors.LLC

Miller Buckfire & Co., LLC

Mirae Asset Wealth Management

NATIONAL REAL ESTATE ADVISORS LLC

National Securities Corporation

Newbridge Securities Corporation

NHCohen Capital LLC

Niagara International Capital Limited

NPB Financial Group LLC

Park Ave Capital Management Intl.

Peak Wealth Group

Pinnacle Financial Wealth Management

Plotkin Financial Advisors LLC

Presidio Exchange Advisors

R.W. Bowlin Investment Solutions

RCF Group

RCM Investments

RCX Capital Group, LLC

Real Estate Tax Strategies Inc

Reef Asset Advisors

Reshape Wealth

Robin Edgar Investments

Sandlapper Securities, Llc

SCF Securities Inc

Securities America

Sequence Financial Specialists Llc

Shorebridge Capital Advisors, Llc

Sigma Financial Corporation

Silber Bennett Financial, Inc.

Slepcevich Financial Group LLC

Sourcenet Investment Services LLC

Spire Investment Partners LLC

Strategic Advantage Financial

Strategic Wealth Planning

Sunbelt Securities, Inc.

Synergy Wealth Mgmt

T3 Trading Group, Llc

TADA Wealth Advisors, Inc.

TAG Group, Inc

Tax Savings Professionals

The Merchants Financial Group, Ltd.,

Trustmont Financial Group, Inc.

Tryon Investments, LLC

United Planners Financial Services Of America A Limited Partner

Vestech Securities

WestPark Capital

Whitehall-Parker Securities, Inc.

Xnergy Financial LLC

Zito Wealth Strategies, Inc.

- Affiliate Firms

A4 International

AI Insight

Arete Capital Markets

Baker & McKenzie LLP

Bowen Enterprises LLC

Buttonwood Investment Services LLC

CFX Markets

Community National Bank

Computershare

Discovery Data

DLA Piper

DST Systems Inc

Engage-BD

Evolv Capital

Factright, LLC

FinanceIQ

Financial Media Group

Great Lakes Fund Solutions, Inc.

Groom Law Group, Chtd

Integro Insurance Brokers

IPA - Investment Program Association

JCC Advisors, LLC

JPM llp

Kaplan Voekler Cunningham & Frank PLC

KINGDOM Trust

Kirton & McConkie

Kutak Rock LLP

Mainstar Trust

MBD Solutions

MGL Consulting

Mick Law PC, LLO

Miterko & Associates

Morris Manning & Martin LLP

Next Generation Services, LLC

NuView IRA

Orchard Securities - MBD

Paliotta & Associates

Phoenix American Financial Services, Inc.

Real Assets Adviser

Real Assets Adviser - Institutional Real Estate Inc.

Robert A. Stanger & Co., Inc.

Rockspring

S2K Financial

SC Distributors, LLC

Securities Transfer Corporation

Skyway Capital Markets, LLC

Sorensen Entity Services

Spotlight Marketing Communications

The Bowman Law Firm LLC

The DI Wire

WealthForge

- Sponsor Firms

1031 Xpress Inc

AEI Capital Corporation

American Capital Group

APX Energy, LLC

Ascendant Capital, LLC.

Black Creek Group

Bluerock Real Estate

Bourne Financial Group, LLC.

CAI Investments

Cantor Fitzgerald

Capital Square 1031

Carter Multifamily

CNL Securities Corp.

Cole Capital

Croatan Investments

District Investments, LLC

EcoVest Capital

ExchangeRight Real Estate

Four Springs Capital Trust

FS Investments

GK Development Inc

Go Store It Partners, LLC

GPB Capital

Green Rock, LLC

Griffin Capital Corporation

Guggenheim Partners

GWG Holdings, Inc.

Hamilton Point Investments LLC

Hartman Income REIT

HC Government Realty Trust, Inc.

Highland Capital Management

Hines Securities

Inland Private Capital Corporation

Inland Real Estate Investment Corporation

Inspired Healthcare Capital

iSelect Fund Management, LLC

KBS Capital Markets Group LLC

KWB Hotels

Landmark Dividend

Legion Capital

Livingston Street Capital

Lloyd Jones Capital

Lodging Opportunity Fund, REIT

MCI Megatel Capital Investment

MDS Energy

Merritt Anderson

MFP Manager, LLC

Moody National Companies

NorthStar Securities, LLC

Old Ivy Capital Partners, LLC

Participant Capital

Passco Companies LLC

Peachtree Hotel Group

Phillips Edison & Company

Phoenix American Hospitality

Preferred Apartment Communities Inc

Provasi Capital Partners

Resource

Resource Royalty, LLC

Royal Oak Realty Trust

SAFE IRA INVESTMENTS

SANDLAPPER Capital Investments, LLC

Sealy & Company

Shopoff Realty Investments

Sixty West, LLC

SmartStop Asset Management, LLC

Spring Hills Holdings, LLC

Starboard Realty Advisors LLC

Stira Capital Markets Group

Sullivan Wickley

Terra Capital Partners LLC

The Gladstone Companies

The Lightstone Group

Time Equities Inc

Tri-Land Properties, Inc.

Triloma

Triton Pacific Securities

US Energy Development Corporation

Virtua Capital Management

Webb Creek Management Group, LLC

*indicates exhibiting firms

Media Partners

Exhibitor Info.

Exhibitor Schedule

Set-up Hours:

- Sunday, March 25

1:00-6:00 pm - Monday, March 26

8:00 am-4:00 pm

Show hours:

- Monday, March 26

6:00-7:00 pm - Tuesday, March 27

8:00 am-7:30 pm - Wednesday, March 28

7:30-9:00 am

Exhibitor move-out:

- Wednesday, March 28, 2018

9:00 am-12:00 pm

*Carriers MUST be checked in by 9:00 am

*All exhibitor materials must be removed by 12:00 pm

Marketing

![]() All exhibitors need to send a current logo to Jennifer Fitzgerald, Director of Marketing.

All exhibitors need to send a current logo to Jennifer Fitzgerald, Director of Marketing.

Program Book and Mobile App Ads and Materials

Diamond exhibitors receive:

- Full page, 4-color ad in printed conference program – DUE Friday, March 2, 2018

- Banner ad in event mobile app -- DUE Friday, March 9, 2018

- Logo displayed, linking to URL of choice, in event mobile app -- DUE Friday, March 9, 2018

- Company profile included in the event mobile app -- DUE Friday, March 9, 2018

- Logo recognition by category on the ADISA website, printed program book, select pre-event eblasts, onsite signage and general PowerPoint

Platinum exhibitors receive:

- Half page, 4-color ad in printed conference program -- DUE Friday, March 2, 2018

- Brief company profile included in the event mobile app -- DUE Friday, March 9, 2018

- Logo displayed, linking to URL of choice, in event mobile app -- DUE Friday, March 9, 2018

- Logo recognition by category on the ADISA website, printed program book, select pre-event eblasts, onsite signage and general PowerPoint

Gold exhibitors receive:

- Brief company profile included in the event mobile app -- DUE Friday, March 9, 2018

- Logo displayed, linking to URL of choice, in event mobile app -- DUE Friday, March 9, 2018

- Logo recognition by category on the ADISA website, printed program book, select pre-event eblasts, onsite signage and general PowerPoint

Silver exhibitors receive:

- Recognition by category on the ADISA website, select pre-event eblasts, onsite signage and general PowerPoint

- Logo displayed in event mobile app

Bronze exhibitors receive:

- Logo recognition by category on the ADISA website, printed program book, select pre-event eblasts, onsite signage and general PowerPoint

- Listing in event mobile app

Printed ad specs: (for Diamond and Platinum exhibitors only)

- Full page: 6x9" vertical, 4-color

- Half page: 6x4.5" horizontal, 4-color

- Artwork must be in PDF format.

- Must be 300 dpi or higher.

- Include all fonts and graphics embedded in files.

- Ads created in Microsoft Word, Publisher, PowerPoint or any other word processing program will not be accepted. These files must be exported to PDF.

- Ads smaller than the specified size will be centered on the page.

ADISA Contact Information

Erin Balcerzak

Membership Services Coordinator

GES – Global Experience Specialists, Inc.

800.801.7648

GES will be onsite show to assist you in coordinating any last minute services, ordering additional products and answering any questions you may have.

Jennifer Fitzgerald

Director of Marketing

.tmb-thumbnail.jpg?Culture=en&sfvrsn=419c6ca8_1)

.tmb-thumbnail.jpg?Culture=en&sfvrsn=cfa24113_1)

.tmb-thumbnail.png?Culture=en&sfvrsn=fb55f702_1)

.tmb-thumbnail.jpg?Culture=en&sfvrsn=d9a6abdd_1)

.tmb-thumbnail.png?Culture=en&sfvrsn=969e4941_1)