Event Details

Event Schedule

*last updated 3/10/2020

Education Tracks

- 1031 Like-kind Exchanges

- Alts in general (BDCs, Interval Funds, Reg A+, Debt, Preferred Offerings, etc.)

- Alternative Investing 101/102 (fundamentals and best practice)

- BDAC (Broker-dealer Advisory Council)

- Energy

- Real Estate (real estate outlook, REITs)

- BD Practice management

- RIA/Family Office Practice management

- Tax (Opportunity Zone Funds, Conservation Easements, etc.)

- Technology/Security

- Applied academic research results

- Sponsor only concerns

- New Innovative Products

- Legislative & Regulatory Updates

Special Guests

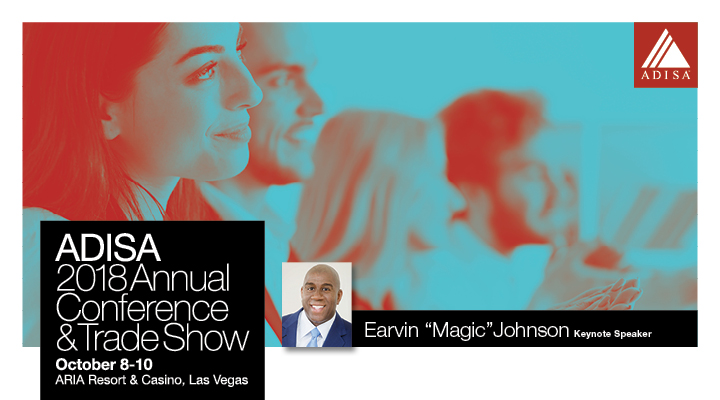

Earvin "Magic" Johnson

For the last two decades Johnson has consistently turned heads with his unprecedented partnerships. In his early years as an entrepreneur, he forged an alliance with Sony Pictures to develop Magic Johnson Theatres. In 1998, he teamed with Starbucks to become the only franchisee in the history of the company, acquiring and eventually selling 125 stores in a lucrative move which further solidified his position in the business world. Both ventures served as catalysts for redevelopment in urban communities, and are widely recognized as the corporate blueprint for engagement and success with urban consumers across America.

Still a commanding presence in the sports world, he made history in 2012 when he became co-owner of the Los Angeles Dodgers, a Major League Baseball franchise that was purchased for an astronomical $2 billion dollars. It was the highest purchase price for any professional sports team at the time. He also co-owns the Los Angeles Sparks of the WNBA and Major League Soccer’s Los Angeles Football Club.

Johnson continues to expand his influence through a number of other investments. He currently has controlling interests in EquiTrust, a $14 billion financial services company, ASPiRE, an African-American television network, and SodexoMAGIC, a food service and facilities management company.

The Lansing native is constantly evolving and remaining relevant in a dynamic digital age by broadening his scope into infrastructure and technology. Through a newly formed fund, Johnson is investing more than $1 billion dollars on infrastructure improvement in the United States. His technology endeavors include the acceptance of a board position with Square, a mobile payment company that supports small businesses and entrepreneurs. Likewise, operating under the philosophy that true success is making others successful, he is also one of the leading investors in a number of minority-owned tech companies that include Jopwell, a diversity and hiring recruiting platform, and Walker & Co Brands, a company that develops health and beauty products for people of color. He is deliberate in his investment strategy to bring positive impact to the community.

Johnson also serves as Chairman and Founder of the Magic Johnson Foundation, where his commitment to transform Urban America continues through HIV/AIDS Awareness and Educational Programs. Remaining true to his humble Lansing beginnings, he is unwaveringly dedicated to working with major corporations and partners to bring jobs and high-quality products and services to underserved communities.

BOB RICE

Bob is the pioneer educator in our field: his foundational book The Alternative Answer became a Wall Street Journal bestseller, and his Bloomberg and Fox TV spots, “Bob’s Buzzword,” have explained the lexicon to millions of viewers.

He is a Director of Nasdaq Private Markets; a senior consultant to Wilshire Associates and Neuberger Berman; and serves on the board of the Value Line Funds’ investment advisor and the editorial committee of The Institute of Wealth and Investments.

Bob’s firm, Tangent Capital, advises private equity, hedge, and real asset managers and institutional investors. RicePartners.com hosts Bob’s recent award-winning articles, presentations, events calendar, and a library of his TV Buzzwords.

Attending Companies

- Associate Firms

Accretive Wealth Management

Affinity Real Capital

AIG Advisor Group

Alan B Lancz & Associates

Alpha Investing

Alta Investment Group

Alternative Investment, Inc

American Portfolios Financial Services, Inc.

Ameritas Investment Corp

Ameritas Investment Corp.

Anchor Financial Group

Andorra Investment Management

Angel Rock Advisors

Anthem Wealth Management

AOG Wealth Management

Applied Capital, LLC

Archer Investment Advisors

Arete Wealth Management

Argos Family Office LLC

Arkadios Capital

Arque Capital Ltd.

ASG CAPCO CORP

Ashland Pacific

Atlanta Capital Group

Atomi Financial Group

Ausdal Financial Partners

BANDER Investments

Bank Fund Equities, Inc.

Belpointe Asset Management LLC.

Berthel Fisher & Company Financial Services Inc

Blue Summit Financial Group

Blue Summit Wealth Management

Breakwater Capital

Bren Ventures

Bridge Valley Financial Services

Business Transition Services, Inc

Cabin Securities

Cabot Lodge Securities, LLC

Calton & Associates Inc

Cambria Capital

Cambridge Investment Research Inc

Cantlon Financial Planning, LLC

Capital Financial Services, Inc.

Capital Management Analytics

CapStack Partners

Capstone Wealth Planning

Capulent LLC

Cardinal Capital

Cascade Financial Management Inc

Catalina Capital Group

Catalyst Wealth Management

Centaurus Financial, Inc.

Center Street Securities, Inc.

Certis Capital Management

Cetera Financial Group

Chalice Capital Partners, LLc

Claraphi

Claraphi Advisory Network, LLC

Clear Direction Investments

Clear Direction Investments LLC

Clear Stream Advisors

Coastal Equities, Inc.

Colorado Financial Service Corporation

Commonwealth Financial Network

Competitive Edge Wealth Management

Comprehensive Financial Solutions and Tax

Concorde Asset Management, LLC

Concorde Investment Services LLC

Corcapa 1031 Advisors

Cornerstone Exchange Services

Cornerstone Real Estate Investment Services

CORPORATE INVESTMENTS GROUP, INC.

Cottonwood Residential

Courtlandt Financial Group, Inc.

Creative Wealth Advisors, LLC.

Crescent Securities Group Inc

cSquared Wealth

CUBED Systems

Cuso Financial Services

Da Vinci Global Consulting, LLC

David A. Noyes & Company

Dempsey Lord Smith, LLC

Derby and Derby

Desert Rose Capital Management, Inc.

DFPG Investments, Inc.

Discipline Advisors, Inc.

Dorado Peak Capital

Dunn Financial, Inc

DWYER FINANCIAL, LLC

- Associate Firms

Elmcore Securities LLC

Emerson Equity LLC

Equifinancial LLC

Fiduciary Wealth Management, LLC.

Financial Architects

Financial Architects, Inc.

Financial Designs, Ltd.

Financial, Insurance, & Tax (FIT) Planning Group

First Financial Equity Corp.

First Financial Equity Corporation

First Guardian Group

FISN/Landolt Securites

FISN/Landolt Securities

Folio Investments, Inc.

Fortitude Investment Group LLC

FourStar Wealth Advisors, LLC

Fox Wealth Advisors

Frontier Wealth Strategies

FSC Securities Corporation

Global Wealth Partners Inc

Gonzalez Family Office

Gotham Investors

Gradient Securities, LLC

H&S Wealth Management

Hartfield Financial & Insurance Services, Inc.

Heritage Capital Advisors Inc

Herr Capital Management, LLC

Hickory Capital, LLC

High Camp Consulting

Highlander Wealth Services, LLC

HN Financial Group

Horev & Associates

IAMC

IAR

IFSG

Independent Financial Group, LLC

Independent Financial Services Professional

Innovative Advisory Group, LLC

INNOVATIVE WEALTH PARTNERS, LLC

Insight Wealth Group

International Assets Advisory, LLC

Investment Advisor Associates Inc

Investment Capital Resources

Investment Security Corporation

IRA Wealth Management

IREXA Financial Services / Wealth Strategies

ISC Group

Joseph Stone Capital L.L.C.

JRL Capital Advisors

JRL Capital Corp

JRW Investments

Kalos Capital, Inc.

Kalos Financial, Inc

Karas Partners Inc.

Karen Templeton

KCD Financial

KF Financial Services

Kingsley Family Office

Knapp Financial Advisors

Kolinsky Wealth Management

Kuettel Capital

Kuhn Wealth Management

Ladenburg Thalmann & Co. INC.

Lamont Financial Services

Landolt Securities Inc

Latus Group, Ltd.

Lazari Capital Management Inc.

Legacy Wealth Management, LLC

Legend Capital Group

Life Strategies Advisors

LightPath Capital, Inc.

Lincoln Financial Securities Corporation

Lionchase Holdings

LJCooper Capital Management LLC

Lopez Wealth Management Group

LPL FINANCIAL LLC

Luxor Financial Group, Inc

M.A. Hill Brokers

Maroon Capital Group

Massey Financial Group

MB Investments

MBR Capital Management, Inc.

McRay Money Management, L.L.C.

MEHTA SERVICES COMPANY

Miller Buckfire & Co., LLC

Mirae Asset Wealth Management

Moloney Securities Co., Inc.

Money Concepts Capital Corp.

MStevens Wealth Advisors

- Associate Firms

National Securities Corporation

New Frontier Financial Advisory, LLC

Newbridge Securities Corporation

NPB Financial Group

Npb Financial Group, Llc

Oak Tree Securities, Inc.

Oakwood Advisory Group

Orchard Securities - CTT

Pariter Securities, LLC

Pariter Wealth Management Group

Park Ave Capital Management Intl.

PARK CITY CAPITAL INC

Passed Pawn Advisors

Paul Delle Cese, CPA, RR

Pearson Capital Management

Personalized Retirement Solutions, Inc.

Platinum Wealth Group

Polley Financial

Preylock Holdings

Primex

Purshe Kaplan Sterling Investments

Quiver Financial

R.W. Bowlin Investment Solutions

RCM Investments

RCX Capital Group, LLC

RD Heritage Group

RealtyNet Advisors, Inc.

Redmount Capital Partners, LLC

Regal Securities, Inc.

RELiANCE Investing

Reshape Wealth

Retirement Solutions, Inc

Richfield Orion International

Robin Edgar Investments

Sanctuary Wealth Management LLC

Sandlapper Securities

SCF Securities Inc

Sequence Financial Specialists

Sigma Financial Corporation

Signator Investors, Inc.

Silber Bennett Financial, Inc.

Silverhawk Asset Management, LLC

Simons Financial Network

Solomon Financial Services

Sourcenet Investment Services LLC

South Coast Wealth Management

Stone Hatcher Financial

Stonepoint

Stout Bowman

Strategic Advantage Financial

Strategic Advisors, Inc.

Summit Financial Group Inc

Synergy Wealth Management

Synergy Wealth Mgmt

T3 Trading Group, Llc

TAG Group, Inc

Tangent Capital Partners, LLC

Tate Asset Management

TCFG Wealth Managment

Teninbaum FO

The Enterprise Securities Company

The Fig Group, LLC

The Financial Team, Inc.

the Groop

The Sherer Group LLC

The Strategic Financial Alliance, Inc.

Thomas J. Wolf, CFP

Titan Securities

Trustmont Financial Group, Inc.

United Management Group

United Planners Financial Services of America

US Capital Global Investment Management

US Capital Investment Management LLC

USA Financial Securities Corp

Veripax Financial Management LLC

Vestech Securities

VESTECH Securities, Inc.

VIA Folio

Vista Properties and Investments

WE Alliance Wealth Advisors, Inc.

WEALTH STRATEGIES ADVISORY GROUP

WealthGurus(R)

WealthMaker

West Peak Investments

Western International Securities, Inc.

Westpark Capital, Inc.

Whitehall-parker Securities, Inc.

Widener & Asher Asset Management

Wilson Wealth Management, INC.

Xnergy Financial LLC

- Affiliate Firms

*AI Insight

Aprio

Baker & McKenzie LLP

BB&T Capital Markets

Buttonwood Investment Services LLC

C5 Solutions

Community National Bank

*Computershare

CreditGuard, Inc.

*Discovery Data

*DLA Piper

*Engage-BD

Factright, LLC

Financial Services Institute Inc.

FINRA

FINRA - Financial Industry Regulatory Authority, Inc.

*Great Lakes Fund Solutions, Inc.

Handler Thayer, LLP

HillStaffer

iCapital Network

Impact Partnership, LLC

IPA - Investment Program Association

- Affiliate Firms

JM Tax Advocates

*Kaplan Voekler Cunningham & Frank PLC

Kinsale Trading LLC, Publisher of The 7:00’s Report

Kirton & McConkie

Kutak Rock LLP

MacDonald Realty Group

Mainstar Trust

*MBD Solutions

MD Global Partners, LLC

*Mick Law PC

Mick Law PC, LLO

*Mick Law PC, LLO

Miterko & Associates

Moran Reeves Conn PC

New Direction Trust Company

*NuView IRA

Opal Group

*Orchard Securities - MBD

Paliotta & Associates

Patrick Capital Markets, LLC

PENSCO Trust Company

*Phoenix American Financial Services, Inc.

- Affiliate Firms

*Real Assets Adviser

*Real Assets Adviser - Institutional Real Estate Inc.

Reif Law Group

Robert A. Stanger & Co., Inc.

S2K Financial

*SAFFIRE HEDGE

SC Distributors, LLC

*Securities Transfer Corporation

Seyfarth Shaw LLP

*Skyway Capital Markets, LLC

Snyder Kearney, LLC

Sorensen Entity Services

Spotlight Marketing Communications

*SS&C Technologies

Stroock & Stroock & Lavan LLP

Sullivan & Worcester LLP

*The Bowman Law Firm LLC

*The DI Wire

*TNDDA

*UMB Bank, Institutional Banking

White Glove Workshops

Williams Mullen

- SPONSOR FIRMS

AEI Capital Corporation

AEI Fund Management

ALAN GLENN

American Alternative Investments

Amherst

APX Energy, LLC

*Archon Capital

Artivest

*Ascendant Capital

B10 Capital

Black Creek Group

*Bluerock Capital Markets

*Bluerock Real Estate

*Bourne Financial Group, LLC.

*Broad Reach Retail Partners

*CAI Investments

*Capital Square 1031

Cardiff Development Partners

*Carter Multifamily

Casoro Capital

CNL Securities Corp.

Cole Capital

CommonGood Capital

CORE Capital Markets Group Inc

Core Pacific Advisors

Core Pacific Advisors, LLC

*Cottonwood Residential

CP Homes

Cunat, Inc

*Cygnus Capital

*deeproot®

Destra

EB Arrow

EcoVest Capital

*EvrSource Capital

- SPONSOR FIRMS

Florida Atlantic University

*Four Springs Capital Trust

*FS Investments

GK Development Inc

*GPB Capital

*Green Rock, LLC

*Griffin Capital Corporation

Guggenheim Partners

*GWG Holdings, Inc.

*Hamilton Point Investments LLC

Hamister Group, LLC

Hartman

*Hartman

Hartman Income REIT

*HC Government Realty Trust, Inc.

Highlands REIT

Hines & Company

*Hines Securities

http://www.proffittdixon.com

*Inland Private Capital Corporation

*Inland Real Estate Investment Corporation

iSelect Fund Management, LLC

John Henry Oil

KBS Capital Markets Group LLC

Land Investors, LLC

Legion Capital Corporation

Leitbox Portfolio Partners

*Livingston Street Capital

*Lodging Fund REIT III

Luxe Residential

MDS Energy

*Montego Minerals

*Moody National Companies

*Multi Financial Securities Corp.

NATIONAL REAL ESTATE ADVISORS LLC

*NB Private Capita

- SPONSOR FIRMS

*NexPoint

Olympus Property

*Participant Capital

*Passco Companies LLC

*Peachtree Hotel Group

Phillips Edison & Company

Phoenix American Hospitality

*Preferred Apartment Communities Inc

PREP Property Group

*Resource

*Resource Royalty, LLC

*RK Properties

*Sealy & Company

*Shopoff Realty Investments

*Sixty West, LLC

*SmartStop Asset Management, LLC

*Sound West Realty Capital

*Sovereign Partners

*Spring Hills Holdings, LLC

*Starboard Realty Advisors LLC

*The Empire Group LLC

The Entrust Group

The Gladstone Companies

The Kase Group

*Time Equities Inc

TJ Management, LLC

Tortoise

Tri-Land Properties, Inc.

Triloma

*Triton Pacific Securities

Union Square Capital Partners, LLC

*US Energy Development Corporation

VehicleOccupancy

*Virtua Capital Management

*Waypoint Residential

*Webb Creek Management Group, LLC

*indicates exhibiting firms

Media Partners

Exhibitor Info.

Exhibitor Schedule

Set-up Hours:

- Sunday, October 7

1:00-6:00 pm - Monday, October 8

8:00 am-4:00 pm

Show hours:

- Monday, October 8

6:00-7:00 pm - Tuesday, October 9

8:00 am-7:30 pm - Wednesday, October 10

7:30-9:00 am

Tear-down hours:

- Wednesday, October 10

9:00 am-1:00 pm

*All exhibitor materials must be removed by 1:00 pm.

Marketing

![]() All exhibitors need to send a current logo to Jennifer Fitzgerald, Director of Marketing.

All exhibitors need to send a current logo to Jennifer Fitzgerald, Director of Marketing.

Program Book and Mobile App Ads and Materials

Diamond exhibitors receive:

- Full page, 4-color ad in printed conference program -- DUE Friday, September 14, 2018

- Logo displayed, linking to URL of choice, in event mobile app - DUE Friday, September 14, 2018

- Banner ad on event mobile app -- DUE Friday, September 14, 2018

- Brief company profile included in the event mobile app -- DUE Friday, September 14, 2018

- Recognition by category on the ADISA website, select pre-event eblasts, onsite signage and general PowerPoint

Platinum exhibitors receive:

- Half page, 4-color ad in printed conference program -- DUE Friday, September 14, 2018

- Brief company profile included in the event mobile app -- DUE Friday, September 14, 2018

- Logo displayed, linking to URL of choice, in event mobile app -- DUE Friday, September 14, 2018

- Recognition by category on the ADISA website, select pre-event eblasts, onsite signage and general PowerPoint

Gold exhibitors receive:

- Brief company profile included in the event mobile app -- DUE Friday, September 14, 2018

- Recognition by category on the ADISA website, select pre-event eblasts, onsite signage and general PowerPoint

- Logo displayed, linking to URL of choice, in event mobile app

Silver exhibitors receive:

- Recognition by category on the ADISA website, select pre-event eblasts, onsite signage and general PowerPoint

- Logo displayed in event mobile app

Bronze exhibitors receive:

- Recognition by category on the ADISA website, select pre-event eblasts, onsite signage and general PowerPoint

- Listing in event mobile app

Printed ad specs: (for Diamond and Platinum exhibitors only)

- Full page: 6x9" vertical, 4-color

- Half page: 6x4.5" horizontal, 4-color

- Artwork must be in PDF format.

- Must be 300 dpi or higher.

- Include all fonts and graphics embedded in files.

- Ads created in Microsoft Word, Publisher, PowerPoint or any other word processing program will not be accepted. These files must be exported to PDF.

- Ads smaller than the specified size will be centered on the page.

Please email ads to Jennifer Fitzgerald, jfitzgerald@adisa.org.

ADISA Contact Information

Erin Balcerzak

Membership Services Coordinator

Jennifer Fitzgerald

Director of Marketing

GES – Global Experience Specialists, Inc.

800.801.7648

GES will be onsite show to assist you in coordinating any last minute services, ordering additional products and answering any questions you may have.

Hotel & Travel

Hotel & Travel

All conference events will be held at ARIA Resort & Casino, Las Vegas.

ARIA Resort & Casino

3730 South Las Vegas Boulevard

Las Vegas, NV 89158

Please note: The ADISA hotel block is almost sold out, and our conference rate and/or complimentary rooms are in very limited supply.

If you are a Broker-Dealer, RIA or Family Office, you may be waitlisted or there may not be discounted rooms available, depending on your arrival/departure.

If you are a Sponsor or Affiliate, you can still book through this link for a limited time: https://book.passkey.com/go/ADISAM18.

If you would like assistance with the hotel, please contact Erin Balcerzak at ebalcerzak@adisa.org.

BEWARE of hotel

reservation scams: There are several hotel reservation “pirates” who somehow get prior year meeting attendance lists and then approach past attendees to reserve their hotel rooms and in so doing either steal credit card information or

broker a non-refundable reservation with extra junk fees. Please note that ADISA does not call or send out emails to individuals to solicit hotel reservations. You should use only the link provided in our reservation system to book your room. Please

contact us with any questions.

.tmb-thumbnail.png?Culture=en&sfvrsn=e58eb229_1)

.tmb-thumbnail.jpg?Culture=en&sfvrsn=68da34_1)

.tmb-thumbnail.jpg?Culture=en&sfvrsn=39524d7b_1)